Hi All.

Haven't been posting on the market for a few days dy...:p

Since I last post,

- FKLI hit a new high of 1,719 following the bullish pennant breakout. Still, it fall short of the

initial target of 1,740-50.

- We'll see if the current pullback is mere temporary weakness, or we have actually topped at 1,719

high. Technical internals are siding the 1,719 top theory for the moment.

- Today saw a close in a nice little Shooting Star, hovering right over yesterday's long white. A lower

close (preferably after a lower open), shall confirm the pattern's nature as a reversal signal.

- Bulls need to bring price back above 1,710-20 level to continue the rally.

Bears need to close price lower tomorrow, & preferably take out the 1,680-85 support asap to

secure their control over near term price direction.

|

| FKLI - Shooting Star...Topped at 1,719? (April 17) |

>>>

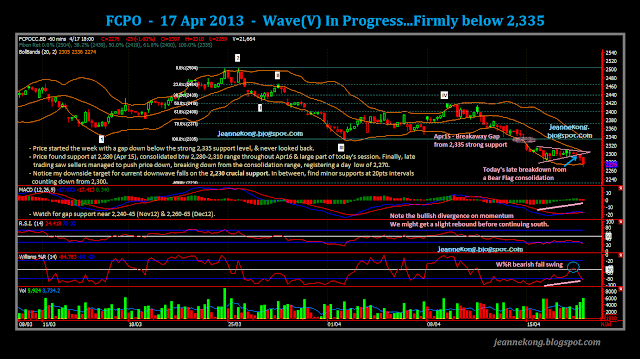

- FCPO broke below the strong 2,335 support level by starting the week with a breakaway gap.

- It then continued firmly south to 2,280 support level. Yesterday saw price bouncing between

2,280-2,310 range.

- Today, tight consolidation most part of the day, before a decisive breakdown from the congestion

area in late trading. Price fall to 2,270 minor support in a hurry, before closing slightly higher at

2,274.

- We may see respite from the bulls in early trading tomorrow, as suggested by slight divergence on

the momentum. Watch 2,280 | 2,300-15 resistance. If not broken, we shall continue selling on

strength towards the fibo target of 2,230 crucial support.

|

| FCPO - Bear Flag breakdown, Wave(v) in progress towards 2,230 (April 17) |

>>>

Last but not least, can't help but to join the latest hype in town.

The GOLD Fever !!

The precious metal shed nearly $300/ounce off its 'preciousness' within two trading session.

Initially, I believe its merely technical selling upon breakdown of the major 1,530-50 support band, following a weak China CPI data & >250pts plunge on the Dow.

Later, selling gathered steam, probably due to the hype over several other 'news', longer term investors started joining the sell-off.

Price plunge in a flurry of selling, which later turned into margin selling, I believe, leaving price free-falling >$100/ounce for two straight days.

CME decision to hike trading margin brought some relief, we saw price finally managed to find support near 1,320 level & bounces back a little.

A look on the chart revealed that price may have indeed hit a temporary low near 1,320 level, being 161.8% fibo projection target for the downswing from 1,900-1,550.

We might see some technical rebound, probably enhanced by bargain-hunting at low prices, towards 1,420-40 | 1,480-1,500 | 1,530-50 (now turned strong resistance).

Given the importance of the 1,530-50 support previously, price will tend to retest it, confirmed it has turned resistance, before we see further selling.

Hence, despite all the bearish tone we get over the wire, I believe we are in for some counter-rally on Gold in the near term.

We shall see then....:)

|

| GOLD - May see temporary rebound after massive sell-off. (April 17) |

Happy Hunting/Mining !! :)

~* April 18 *~

ReplyDelete=FKLI=

- On the daily, formed a long-legged doji star.

- Failed to confirm yesterday's Shooting Star reversal signal as the day close slightly higher at 1,702.5, from yesterday's 1,700.5.

- Today's higher close seems to give bulls a slight advantage relative to the bears. We may continue with further consolidation tomorrow, with slight bullish bias.

- Watch if bulls are able to push through the 1,711 resistance tomorrow.

- Support still at 1,690-96 | 1,680-85

>>>

=FCPO=

- Price lingers around 2,264-2,272 low in the morning. Before slightly picking up steam & close the morning session above the range at 2,276.

- Afternoon session started with a bang, price shoot up to 2,290 high at open.

- Without much pauses in between, saw price continue to its run up, all the way to 2,315 day high. Forming a deep U- or V-shape rebound.

- We may continue to see further bounce tomorrow towards the 2,325-2,335 gap. Nonetheless, expect price to retrace part of the rally first, given the steep slope of the afternoon climb.

- Watch for strong support @ 2,295-2,305, followed by 2,280-85 | 2,265-70.

- Resistance @ 2,325-35 gap | 2,350-60