EXECUTIVE SUMMARY

A NEUTRAL outlook. We have a Neutral outlook on the Malaysian market

going into 2012 as the combination of uncertain growth outlook in the US and

Asia coupled with a possible recession in Europe cloud the prospects for strong

earnings growth locally. While we see Malaysia likely to avoid slipping into a

recession, the deficit reduction exercises undertaken by Eurozone economies may

well tip their slow growing economies into a recession. In any case, for

Malaysia, we see earnings growth slipping to between mid single digits and low

double digits, a pale shadow of what it was in 2006, 2007 and 2010 when

earnings growth came in between 20 to 30%. Newsflow on developments surrounding

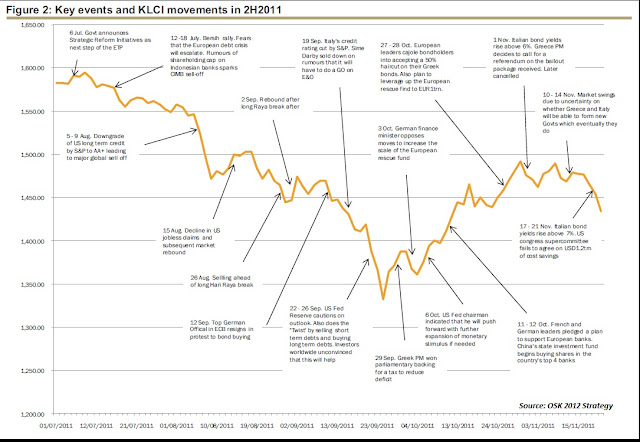

the handling of sovereign debt in Europe and the US will also likely lead to

volatile markets worldwide. As such, in the short term, we are faced with

volatile markets which will likely give way to a dampened economic outlook.

We advise investors stay cautious into mid 2012 and

focus on Defensive sectors such as Consumer, Telco, Healthcare and Media. Our

2012 KLCI fair value is 1466 pts based on a PER of 13.5x or 1 standard

deviation below the historical average of 16.6x given the uncertain market

conditions.

BUT opportunities to TRADE. That being the case, despite our overall Neutral

stance, the volatility expected should give rise to plenty of Trading

Opportunitites. We advise investors to Trade on Cyclical sectors such as Banks,

Oil & Gas and Construction as the market dips or rallies strongly. The

trading strategy to adopt is:

Buy when the KLCI falls

towards the 1300 pts level as

the broader market then offers a 10% upside to our 2012 fair value. As we do

not see Malaysia entering into a recession, we do not see an earnings

contraction and value should emerge closer to 1300 pts. A combination of still

positive earnings growth, low foreign shareholding and the Economic

Transformation Programme should mean Banks (leading the economy), O&G and

Construction (beneficiaries of the ETP) will present good entry points at that

level of the market.

Sell when the KLCI rises

towards the 1500 pts level as

the market will be overpriced then. We still see fundamentals remaining weak.

Although the 3Q2011 earnings season may have seen a slight improvement q-o-q,

most of the improvement was focused on the Small caps where analysts have had

time to pare down forecasts. On the flipside, Big caps continued to slide with

the potential for more downgrades in the coming 2 quarters.

7 sectors to focus on. Given our generally defensive outlook, investors are

advised to focus on the Consumer, Telco, Healthcare and Media sectors as

mentioned above. At the same time, when trading opportunities present

themselves, Banks, O&G and Construction should come into play. To note that

we are only Overweight on 7 sectors, Neutral on 9 and Underweight on 2 sectors.

Top Buys reflect this

overall strategy. In terms of

our Top Buys, they reflect this overall strategy. 6 of our Top Buys, namely

Axiata, PetGas, Telekom Malaysia, QL Resources, KPJ Healthcare and Media

Chinese reflect our Defensive Strategy while 2 others are from our Alternative

Defensive Buys namely AirAsia and TRC Synergy. While coming from the cyclical

sectors of Transport and Construction, we believe these 2 companies can

leverage upon falling fuel prices and MRT contract certainty to warrant defensive

investment in 2012. Finally, we choose Maybank and Dialog as our Top Trading

Buys to round off our Top 10 for 2012.

Source: OSK 2012 Strategy

No comments:

Post a Comment