Hi All.

Since I last posted on the Mar12 Dark Cloud Cover closing at 1,653, FKLI has dropped another hefty 36pts to close at 1,617.5 today, Mar18, hitting an intraday low of 1,608 in fact.

So, the Mar12 setup targeting 1,674 high has obviously failed.

The previous rebound from 1,593 low ended at 1,668.5 high, & had subsequently reversed into the current down swing.

When the index readjusted & closed down 13pts on Friday below its mid-band support of about 1,635, FKLI follow suit with a last-15min plunge below its own 1631-34 support, & closed low 1,625.5.

I was doubting the violation of the daily mid-band support, as the news of a change of weightage effective Mar18 on the KLCI components seemed little known.

I wasn't aware of the change myself, until being alerted by my broker following the plunge late Friday.

Well, the doubt on whether the violation of the mid-band was all cleared when we open gapping lower to 1,618.5 this morning on FKLI.

Price then retest 1,620-21.5 level but soon gave up & plunge together with the underlying cash market, hitting a low of 1,608, an hour into trading.

Later saw price rebounded to congest around 1,614-1,619 range before closing at 1,617.5 for the day.

Okay. I must admit recent price movement on the FKLI is confusing me & my analysis, while its eating into my capital with its wild swings up & down.

Initially, I was seeing it as a consolidating flat within 1,587-1,640 range.

Then, came the breakout from 1,640 to the upside. ...Wrong!!...

The breakout was follow by another two gap ups, sending price bullishly up along an uptrend line, thought that's a reversal up from previous downtrend. Did a fibo projection & find a target of 1,674. Price hit high at 1,668.5 & reversed down. ... Snap!!... -_- ///

Since price had pullback below daily-mid-band, its a confirmed reversal downward now. ...dizzy....@_@''

Having no luck with trendlines, flag/flat/triangle...etc...

At last, I decided its time to resort to Elliott Wave to tell me what exactly is going on...

By today's close, what we know for sure now is:

(1) Price is in a corrective move throughout the rebound from 1,585.5 low up to recent high of

1,668.5. Unfolding in 3-waves patterns, rather than the motive 5-waves movement.

(2) The drop from 1,668.5 recent high has been confirmed to be a reversal, rather than a uptrend

pullback, following the violation of daily mid-band support around 1,631-33 on Friday, Mar15.

Counting the drop from pivot high of 1,668.5, it is quite possible that the correctional mode since late Jan might have ended.

To confirm the resume of the previous downtrend from 1,705 peak, we will need to see further drop below today's low of 1,608, giving a 5-wave pattern to the current down swing from 1,668.5 high.

This is the counts I drafted on my trading log after market close.

.png) |

| FKLI - Wave Count Draft I (Mar 18) |

After several possible counts, I think this version fits the current movement best, but do take note that this is a really amateur wave counts & might just be erroneous...i.e. follow at your own risk...~_~''

Shall anyone find something funny with the counts, kindly let me know so I can rectify it.

Assuming the counts are right, a fibo projection gives the next drop an end-target of around 1,587. Shall we go there tomorrow, it will spell the resume of the downtrend from FKLI all-time high of 1,705.

Of course, there's another much safer way to trade the market from here.

Assuming we have yet to finish with the drop from all-time high of 1,705, we expect further downward movement.

Hence, we can patiently wait for a convincing break below the LT support of 1,587, then safely enter our trade at the first retracement high.

Another approach will be to stick to the news & make sure you are among the first ones to hear that long-delayed dissolution announcement. Then, take the short on panic selling. ...LOL...

Perhaps this is an omen to the long-awaited parliament dissolution anouncement?...huhu...:p...

Anyway, please, NEVER trade on speculation...

>>>

On FCPO

CPO price failed to continue the bullishness saw on Friday, Mar15.

Price opened slightly lower & gradually retracing Friday's rise in a small 30pts range day, closed 2,383, below previous immediate support of 2,390-2,400.

The level of 2,360-70, proven solid after several test past two weeks, shall not be violated for the Wave4 to continue unfolding to the upside.

Overhead, resistance is still the same at 2,400-20 | 2,450-70.

Wave4 shall not overlap Wave1, hence, mark our ultimate resistance at 2,476, Wave1 low registered on Feb15.

The Mar1-20 export figures due out soon might be the reason behind the quiet range, as traders could be holding back on their positions for the moment.

On another note,

Losing the status may further depressed the already weak export demand for Malaysia CPO, as rival Indonesia lower-taxed exports will appear even more attractive than now.

This may add to the misery of our current high-stockpile, low-demand CPO industry, not to mentioned the suppressed price squeezing tight on the operating margin.

While it's still about three quarters away from the GSP expiry, sooner or later, the issue will come to focus, given that EU's (3rd largest importer) rising demand is one of the few new market segment our local exporters are targeting, amid slowing demand from our biggest importer, China.

Anyway, we'll see if the bulls are ready to move again in this new trading week.

+progressing,+Wait+for+long+entry.png) |

| FCPO - Wave4 stalled, Awaiting a long entry. (Mar18) |

Okay. That's about all.

Happy Hunting!! :)

.png)

+progressing,+Wait+for+long+entry.png)

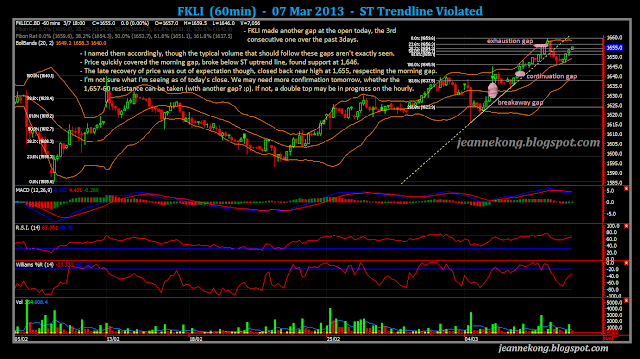

+-+FKLI+-+exhaustion+gap+at+1,659.5.png)